Over the past few months there have been clear signs that the breakneck speed of growth of the coffee shop market may be about to drop.

This flattening out can largely be put down to the recession and saturation in urban locations. Data analyst Allegra Strategies claims the coffee market will cope reasonably well with the current recession. However, it also predicts that outlet openings will slow from its current level of 12.6% annual growth to 7.7% over 2009. The downturn looks set to effect another change in the sector. Traditionally, it has shunned advertising, but to sustain profits and footfall in the current market, more aggressive tactics are coming to the fore.

A decade ago, there were only about 500 branded coffee outlets in the entire country. By the end of 2008, this number had rocketed to about 3700. As well as the big three chains - Starbucks, Costa Coffee and Caffe Nero - a host of others have appeared on the high street, including Caffe Ritazza, BB's and Coffee Republic. According to Allegra, the average number of coffees sold per week at branded outlets has tripled from about 3m in 2000 to 9.1m in 2008.

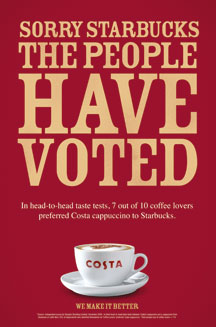

This raises the question as to whether there is room for further growth in the market. One of the clearest hints that a market is maturing is an inability to find consumers new to the segment. Costa's latest ad campaign, which pro-claims the superiority of its cappuccino over that of its rival Starbucks, certainly seems to suggest that new custom is harder to come by.

Jim Slater, marketing director at Costa, points to a 2.2% growth in its like-for-like annual sales as evidence that the sector is still performing well. Costa plans to open 100 further outlets in 2009, and Slater says the current campaign is designed to persuade customers to 'walk that extra 50 yards past Starbucks to a Costa'.

Using advertising to knock a competitor is nothing new, with examples relating to brands as diverse as Nationwide and Asda. However, it is a strategy that is often criticised by experts who believe it serves only to weak-en a sector and cheapen the brand involved.

Slater admits that Starbuck's recent PR problems, including reports of store closures and chief executive Howard Schultz's spat with UK business secretary Lord Mandelson, have allowed Costa to 'push against an open door' with its marketing.

However, Slater argues that the campaign is strategic, rather than opportunistic, and stops short of being a focused attack on its rival. 'We haven't criticised Starbucks. We're genuinely confident about our product superiority and it's the right time to tell people,' he says.

Greig McCallum, strategic managing partner at marketing agency Balloon Dog, which works with Pret A Manger, believes the economic downturn will bring a rise in such marketing techniques. 'The UK coffee market hasn't reached maturity yet, but the recession has temporarily halted its development,' he says. 'That's why we're seeing brands trying to win from each other, rather than grow the overall consumer base.'

Jeremy Caplin, head of marketing solutions at dunnhumby, sees parallels with the wider retail sector. 'The out-of-home experience of visiting a coffee shop is transferring in-home,' he says. 'That doesn't mean people are being cheap; the growth of Nespresso and Tassimo shows that many are trading-up at home, forcing the coffee shops to fight over a declining market.'

Starbucks has its eye on several ways to boost its market share, including the launch of its first instant coffee brand, Via Ready Brew. Last year it also trialled two fresh formats in the UK, Drive Thru and Drive To. A Starbucks spokes-woman says the brand is committed to enhancing the 'Starbucks experience'.

Both it and Costa believe there is a large group of potential customers yet to be won over. The question remains, however, whether a tit-for-tat marketing turf war is the best way to entice them.