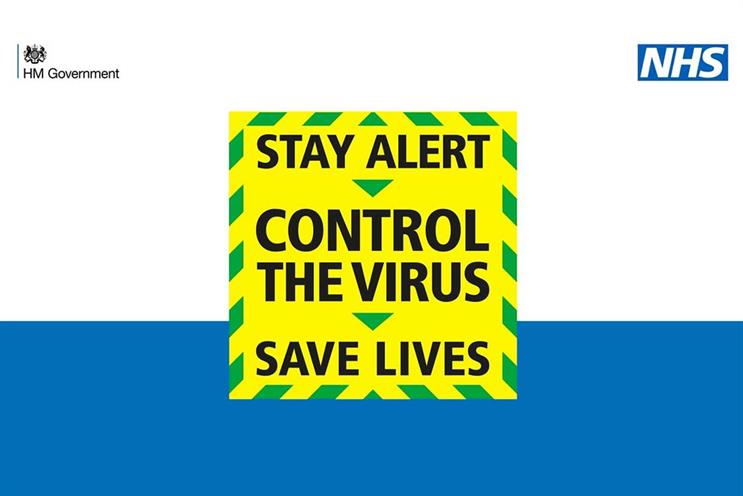

HM Government more than tripled its ad spend to become the UK’s top traditional advertiser last year during the pandemic, according to Nielsen.

The measurement company estimated that the government spent £164m on advertising in 2020, an increase of 238%.

Separately, Public Health England spent £80.5m – almost eight times more than the previous year – making the government agency the seventh biggest advertiser.

Overall, Nielsen estimates total UK advertising spend fell 19% to £7.28bn as many advertisers halted spend during lockdown.

A year in which most businesses faced intense pressures of various kinds has led to widely diverging numbers among the biggest commercial advertisers.

Unilever was the year’s second biggest advertiser, upping its spend by an estimated 76% to £137m, and overtaking 2019’s biggest spender, Sky, which cut expenditure 31% to £124m – the same amount the TV and broadband company spent in 2018.

The significant estimated increase in Unilever's ad spend is in contrast to its global brand and marketing investment, which was flat as a proportion of revenue, and down about 2% in absolute terms.

Procter & Gamble, which was the biggest spender in 2018, reduced its spend last year by 16% to £117m.

There were also major reductions in spend from McDonald’s (down 41%) and Amazon (down 40%) – while Tesco, in contrast, increased expenditure 1%.

Barney Farmer, UK managing director at Nielsen, said: “The past year has been one of huge uncertainty for advertisers and they have had to think carefully about how to adapt their ad strategies to continue connecting with consumers effectively.

"As a result, not only have we seen the UK government increase advertising significantly to ensure vital public health messaging, we’ve also seen the biggest players in the advertising space hone in on data and insights available to them to ensure ad spend is as effective as possible.

“As we work through 2021 we can expect further changes to behaviour and it is vital all advertisers, big and small, rely on up-to-the-minute, accurate data to inform their media buying decisions."

Media channels

Nielsen estimates money spent on advertising on TV, radio, outdoor, press and cinema and does not count channels such as search or social media.

It means the 19% decline to £7.28bn is only an indication of the overall picture as digital advertising is likely to have held up better during the downturn.

With most cinemas closed for large parts of the year and almost all major releases postponed, cinema advertising unsurprisingly took the biggest hit – total spend was down 82% to £54.9m, Nielsen estimated.

The spend in outdoor was estimated to be down 30% to £1.11bn – a less severe decline than estimated by the likes of the Advertising Association/Warc Expenditure Report.

Media pricing was highly volatile last year – especially in the second quarter, during the initial impact of the UK's Covid epidemic – a factor that may impact estimated totals of spending both on a given media channel, and by a particular advertiser.

Farmer added: "While we have seen spend movement across media channels, we have also seen variety in how brands are targeting consumers based on their own specific audience base and needs.”

.jpg)

.jpeg)